Revenue and profit are not the same, and confusing them is one of the fastest ways to misunderstand a business’s real health. A company can bring in millions of dollars and still go bankrupt. It sounds like a paradox, but this is the brutal reality countless businesses face.

They see money flowing in and assume success, only to discover they’re spending even more than they’re earning. It’s like celebrating a full bank account while your credit cards are maxed out and loans are piling up.

If you’re a founder, business owner, investor, or even a curious learner, understanding the difference between revenue and profit isn’t optional; it’s the foundation of every sustainable business decision you’ll ever make.

What Is Revenue?

Revenue is the total amount of money a business generates from selling its products or services before deducting any expenses. It is also called net sales. The formula to calculate revenue is

If you sell 1,000 cups of coffee at $5 each. Your revenue is $5,000. That’s it. No expenses considered yet.

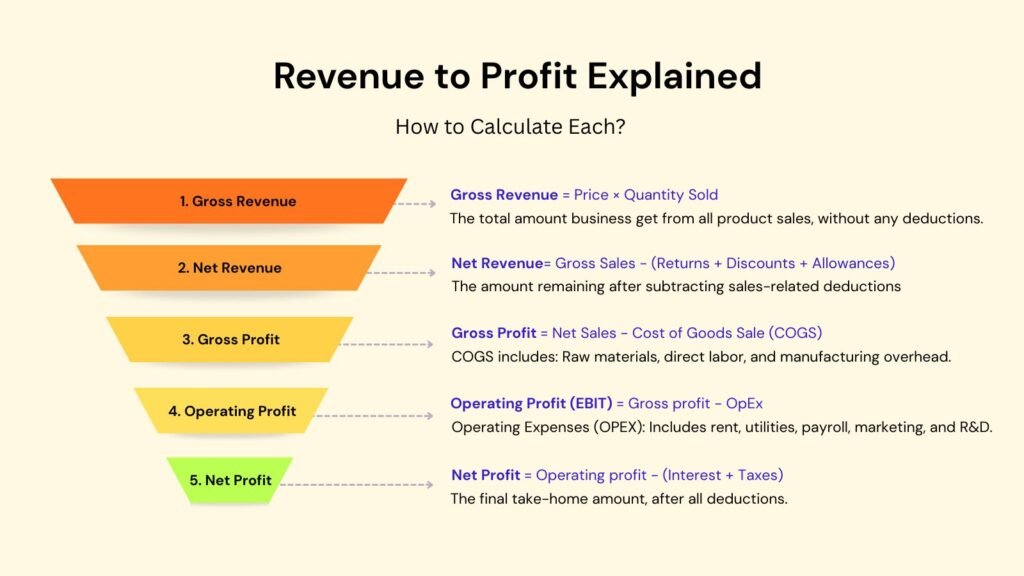

Types of Revenue: Gross and Net

The gross revenue is the total sales before any adjustments. The net revenue accounts for deductions like: Product returns and refunds, Discounts and promotional pricing, Allowances for damaged goods, etc.

Gross Revenue = Price per unit × Number of units sold

Net Revenue = Gross Revenue – [Return + Discount + Allowances]

Most businesses track net revenue because it’s more accurate. If you sold $100,000 worth of products but gave $10,000 in refunds and discounts, your net revenue is $90,000.

What Is Profit?

Profit is what remains after you’ve paid for everything it takes to run your business. It’s the money you actually get to keep. The formula to calculate profit is

The profit definition is simple: revenue minus all expenses. But understanding profit requires knowing there are three distinct types, each revealing something different about your business health.

Types of Profit: Gross, Operating, and Net

1. Gross Profit: It shows how much money you make after covering the direct costs of creating your product or service. It’s calculated by subtracting the cost of goods sold (COGS) from revenue.

Gross Profit = Revenue – Cost of Goods Sold (COGS)

COGS includes only the direct costs: raw materials, manufacturing, labor directly involved in production, and shipping. It doesn’t include things like marketing, rent, or salaries for support staff.

2. Operating Profit: It is also called EBIT (Earnings Before Interest and Taxes). It subtracts all operating expenses from gross profit.

Operating Profit (EBIT) = Gross Profit – Operating Expenses

Operating expenses include rent, utilities, salaries for admin staff, marketing costs, office supplies—everything needed to run the business beyond making the product.

3. Net Profit: It is the ultimate bottom line. The net profit meaning is simple: what’s actually left after all deductions.

Net Profit = Total Revenue – (COGS + Operating Expenses + Interest + Taxes)

This is your take-home money. The profit you can reinvest, distribute to owners, or save for emergencies.

How to Calculate Profit From Revenue?

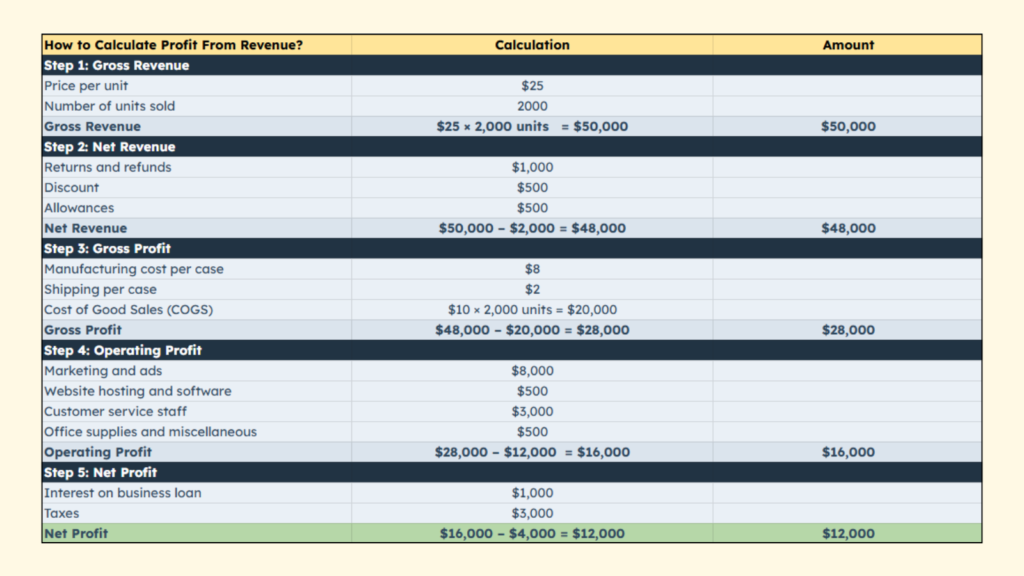

Let’s walk through a real example so you can see exactly how revenue transforms into profit, and where the money goes along the way.

Example: Small E-commerce Business – Imagine you run an online store selling custom phone cases. Here’s your monthly breakdown:

Step 1: Calculate Gross Revenue: The total amount the business gets from all product sales, without any deductions.

- Price per unit: $25

- Number of units sold: 2000

Gross revenue: 2,000 × $25 = $50,000

Step 2: Calculate Net Revenue: The amount remaining after subtracting sales-related deductions

- Returns: $1,000

- Discounts: $500

- Allowances: $500

Total: $1000 + $500 + $500 = $2000

Net Revenue: $50,000 – $2,000 = $48,000

Step 3: Calculate Gross Profit: The amount remaining after subtracting the cost of goods sold (COGS).

- Manufacturing cost per case: $8

- Shipping per case: $2

Total Cost of Good Sales (COGS): 2,000 × $10 = $20,000

Gross Profit = $48,000 – $20,000 = $28,000

Step 4: Calculate Operating Profit: The amount remaining after subtracting monthly operating expenses.

- Marketing and ads: $8,000

- Website hosting and software: $500

- Customer service staff: $3,000

- Office supplies and miscellaneous: $500

Total: $12,000

Operating Profit = $28,000 – $12,000 = $16,000

Step 5: Calculate Net Profit: The final take-home amount, after subtracting interest and taxes.

- Interest on business loan: $1,000

- Taxes (estimated): $3,000

Total: $4,000

Net Profit = $16,000 – $4,000 = $12,000

Notice that even though you “made” $50,000 in sales, your business actually only gained $12,000 in value. The other $38,000 was simply “passing through” your hands to cover the costs of staying in business.

This is exactly how you calculate profit from revenue. Each step strips away a layer of costs until you reach what you actually earned.

What Is More Important for Businesses, Profit or Revenue?

The real answer is you need both. Looking at only one gives you an incomplete picture.

Revenue without profit is unsustainable. You’re building a house of cards that collapses when funding dries up or market conditions shift.

Profit without revenue growth is stagnation. You might be profitable today, but if revenue is flat or declining, you’re slowly dying.

The healthiest businesses balance both:

- Growing revenue demonstrates market demand and expansion potential.

- Improving profit margins shows operational efficiency and sustainability.

- Positive cash flow ensures you can actually pay bills and invest.

Think of revenue as your potential and profit as your reality. Revenue shows what could be. Profit shows what is.

The difference between revenue and profit reveals your cost structure, operational efficiency, and business model viability. Both metrics together tell the complete story of your business health.

Final Thoughts

Here’s what you need to remember: revenue is your scorecard for market demand, but profit is your scorecard for business viability.

You can have the highest revenue in your industry and still go bankrupt. You can have modest revenue and build a thriving, sustainable business. The difference comes down to understanding and managing the gap between what comes in and what goes out.

Revenue tells you if people want what you’re selling. Profit tells you if you can afford to keep selling it.

Too many entrepreneurs chase revenue numbers for the ego boost or the investor pitch. They celebrate hitting $1 million in sales while ignoring that they spent $1.2 million to get there. That’s not success—that’s delayed failure.

The smartest business owners track both metrics religiously. They grow revenue while improving margins. They understand that the goal isn’t just to make sales—it’s to make profitable sales.